Workers’ Compensation Insurance Guide

California

California is the largest single market for workers’ compensation insurance, and the state requires all employers with one or more employees—whether full or part-time—to carry coverage for their employees.

Even if your business is headquartered in another state, you must provide workers’ compensation benefits to your employees in California.

This Workers’ Compensation California Guide will guide you through what you need to know.

An Introduction to Work Comp in CA

With its massive economy—fifth largest in the world—California is home to a wide range of industries and has a huge workers’ compensation system. Its state workers’ compensation fund—the California State Compensation Insurance Fund (SCIF)—is the largest work comp insurer in the state.

The State Fund is generally considered an “insurer of last resort.” As a result, California businesses, and brokers doing business in the state, need to look for new and better options for pricing and safety management in order to stay out of the costly and cumbersome state fund.

Understanding the challenges of buying and managing workers’ compensation insurance in California will help you find your way toward the ultimate goal of workers’ compensation insurance in any state—a cost-effective way to keep workers safe, healthy, and productive.

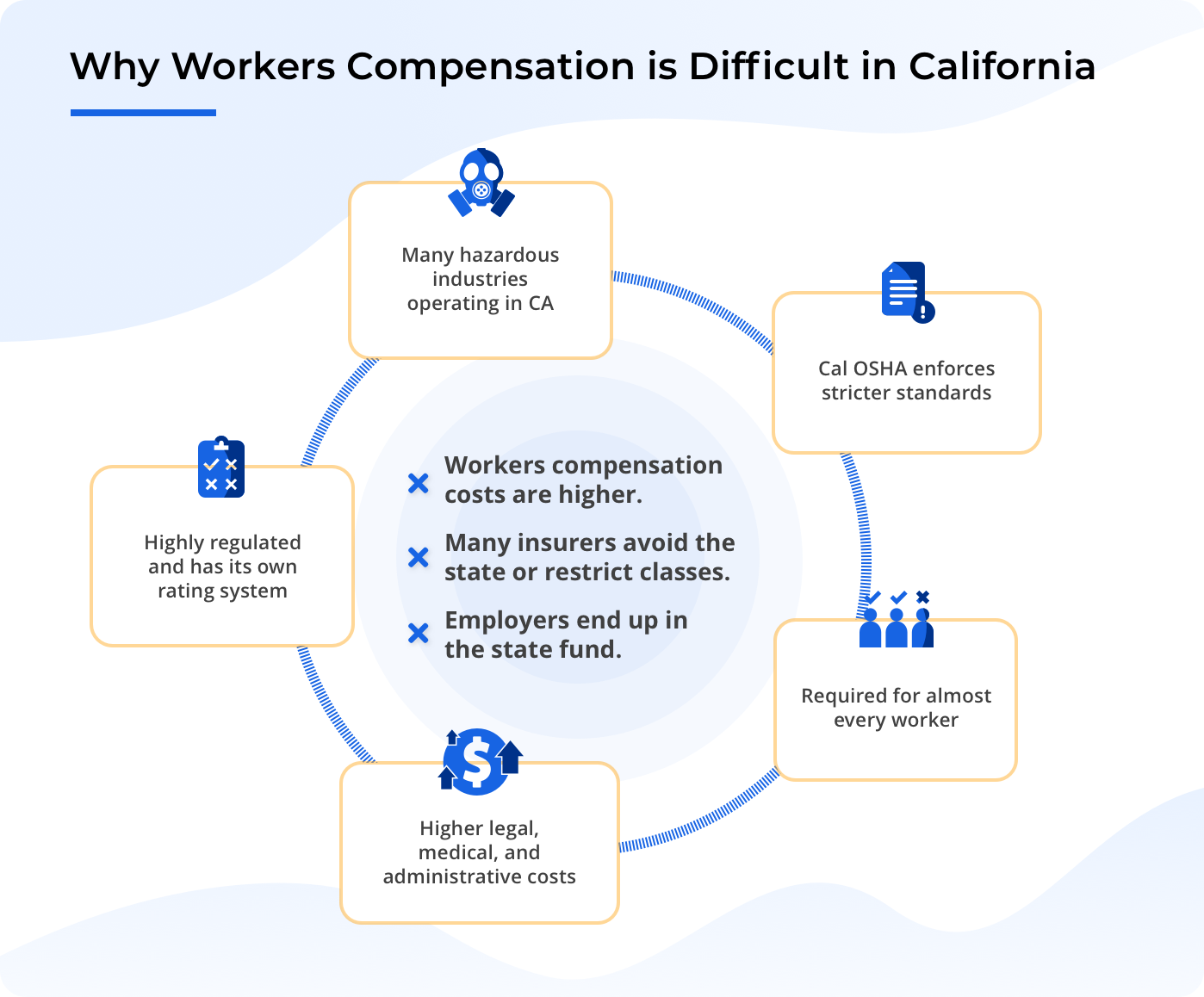

The graphic below depicts some of the factors that make workers’ compensation in California “difficult” in terms of availability, cost, and administration.

- Drivers of workers’ compensation costs in all states—which workers are required to have benefits, the regulatory and rating environment, the types of industries in the state, and the medical treatment patterns and legal environment—are intensified by the size and diversity of California’s economy.

- Combined, these factors lead to higher workers’ compensation costs, prompting many private insurers to avoid California, which, in turn, forces more businesses to obtain workers’ compensation from the more costly and less flexible state fund.

Who needs workers’ compensation coverage in California?

Workers’ compensation coverage is required for almost all employers in California. A few that can be exempt include sole proprietors (although they can elect to have coverage), executive officers who fully own the business, and LLC members who don’t work in the business.1 It is also important to note that Workers’ Comp is not included in commercial liability insurance. It is most often a stand alone policy.

In addition, brokers and employers from other states can get tripped up because certain types of workers who would typically not be required to be covered by workers’ compensation in other states are required to in California. Here are some examples:

Independent contractors and GIG workers

In 2020, the California Workers’ Compensation Law AB5 went into effect, making it more difficult to classify employees as independent contractors and forcing app-based tech companies like Uber and Lyft to reclassify their independent contractors as employees. Even though there are more than 50 types of professions exempt from AB5, exceptions are still rare, and the California attorney general, city attorneys, and local prosecutors can sue businesses over perceived violations.

Undocumented immigrants

The State of California expressly includes “aliens” in its workers’ compensation statute and, like about half of all states, has case law establishing that undocumented immigrant workers are covered under the workers’ compensation statute.

Roofing companies

Roofing companies in California are required to have workers’ compensation insurance even if they have no employees.

Real estate brokers

Unlike most states, a real estate broker is required to cover its agents even if they are independent contractors.

How workers’ compensation works in California

The Division of Workers’ Compensation requires all employers in California to provide workers’ compensation benefits to all employees—even part-time employees. Failure to carry workers’ compensation insurance is a criminal offense unless the employer can prove exemption.

Workers’ compensation benefits in California

Workers in California receive five basic types of workers’ compensation benefits2:

- Medical care

- Temporary disability benefits

- Permanent disability benefits

- Supplemental job displacement benefits

- Death benefits

Harsh penalties for noncompliance

Any employer who doesn’t purchase workers’ compensation insurance is in violation of the California Labor Code, and the Division of Labor Standards Enforcement could issue a stop order against the employer. Employers are subject to harsh punishment:

- Imprisonment for up to a year

- A fine of not less than $10,000 and penalties up to $100,000.3 (Labor Code Section 3700.5)

In addition, the employer would still be responsible for paying the bills related to any injured or ill worker, and the worker has the right to file a civil action against the employer.4

Where Californians can buy workers’ compensation insurance

Employers in California have the option of obtaining workers’ compensation insurance either from private insurers, the California State Compensation Insurance Fund (SCIF), or self-insurance that has met state guidelines. Unlike some states, California does not require employers to prove that workers’ comp coverage was declined by a private insurance company—any employer can choose to get coverage from SCIF.

How workers’ compensation premium is calculated in California

California operates under an open rating system, allowing private insurers to set rates and have them approved by the state. California is not an NCCI state (National Council on Compensation Insurance) and has an independent rating bureau—the Workers’ Compensation Insurance Rating Bureau of California (WCRIB).3 As of 2021, California had an index rate of $1.45 per $100 of payroll.

Experience modification rating is where California employers have the best opportunity to reduce the cost of their workers’ compensation premium. California changed its Experience Rating Plan in 2019 so that only the amount of each of the business’s claims, up to its primary threshold, is used in the Ex Mod computation. The new formula excludes the first $250 of each claim to remove the incentive of not reporting the cost of small claims to the insurer.

A California company is eligible for an experience modifier when payroll during the experience period totaled by classification meets the minimum eligibility threshold, which is adjusted annually to try to keep the population of experience-rated employers somewhat stable.5

Avoiding class code misclassification

With rates so high in California, accurate class code assignments are critical. Misclassifying full-time employees as independent contractors is especially important to avoid, since California has steep penalties in place for misuse of employee classifications.

As mentioned earlier, California’s AB5 law extends wage and benefit protections to “gig economy” workers. The burden of proof is on the employer to demonstrate that the worker is an independent contractor. The California Department of Industrial Relations provides a three-prong test to determine proper classification.

Additionally, identifying accurate California class codes will help to keep the adjusters at the insurance company happy when it comes to a premium audit.

Why workers’ compensation is so expensive in California

California has among the highest workers’ compensation rate in the country, although rates have come down in the past few years. High medical costs, excessive litigation on workers’ compensation claims, and a high number of permanent partial disability claims are some of the reasons behind the high rates. Besides the higher premium rates, claim costs and steep OSHA violations all combine to make the California workers’ compensation system costly.

Cal/OSHA

OSHA approved California’s state plan in 1973. Since then, Cal/OSHA has been aggressively issuing standards that go far beyond the federal OSHA baseline standards. Some examples of Cal OSHA standards that have no federal counterpart include6

Injury and illness prevention program (IIPP)

Cal/OSHA requires every employer to develop and implement a written safety and health program tailed to the specific workplace. This rule is Cal/OSHA’s most frequently cited violation.

Heat stress

Cal/OSHA has specific heat illness prevention regulation for outdoor workers and is currently working on a separate standard for indoor heat hazards.

Long-handled tools

California went beyond OSHA’s general duty clause to prevent injury to agricultural workers from stooping and squatting postures by requiring that workers stop weeding, thinning, and hot-capping (placing cones over plants) by hand and start using long-handled tools.

Hazardous work puts many employers into hard-to-place class codes

Simply because of its economy’s size and diversity, California has numerous employers who fall into the “hard-to-place” category of workers’ compensation. California’s High Hazard Unit names these industries on its 2021-2022 High Hazard Industry List:

| Industry | Number of establishments in California |

| Agriculture | 4,670 |

| Construction | 7,541 |

| Manufacturing | 3,534 |

| Wholesale Trade | 952 |

| Retail Trade | 8,682 |

Medical treatment costs

California has a more prolonged pattern of medical treatments and much higher-than-average costs of handling claims and delivering benefits.7 With such a complicated system, employers need to intervene quickly to ensure that employees get good, quality medical care quickly so that they don’t get “stuck” in the system.

Frictional costs

California has among the highest frictional costs in the country, such as attorney costs for resolving claim disputes.

Tips for lower cost, quality workers’ compensation in California

Here are some tips for finding low cost, high quality workers’ compensation in California. Remember, California may be a difficult state to place, buy, and manage workers’ compensation insurance, but it’s a huge portion of the U.S. economy and too big for businesses, insurance agents and brokers to ignore. With the right workers’ compensation tools, and guidance, it IS possible to have a positive workers’ compensation experience in California.

Avoid the state fund whenever possible

The California State Compensation Insurance Fund is the largest workers’ compensation insurer by premium volume. This doesn’t mean businesses are choosing to purchase coverage there because it’s cheaper or easier to work with—quite the contrary.

Most business are there because either they or their broker believed they could not obtain coverage from a private insurer, either due to their loss history (or lack thereof if it’s a new business) or because they’re in a high-hazard class of business. Always be sure your broker has explored all options, starting with insurance carriers who specialize in hard-to-place industries in California.

Use safety-driven pricing for cheaper workers’ compensation premiums

The Ex Mod is where the opportunity to reduce workers’ compensation premiums becomes possible. But what if a business doesn’t qualify for one in California? Foresight uses technology to help you track and analyze loss data to improve your safety program, reduce incidents, and, ultimately, qualify for or improve your Ex Mod.

Use technology to manage safety compliance and prevent injuries

Safety technology makes managing the complexities of workers’ compensation in California faster, easier, and more accurate—especially when its available on a mobile device and easy for employees to engage with. When technology can track incidents and near misses, capture safety meetings and inspection checklists, and experts can help interpret the data and customize risk management, businesses can minimize the costs associated with claims, lost productivity, OSHA violations, and higher Ex Mods.

Respond to claims quickly

Keeping claim costs down in California requires immediate reporting on the date of injury and a fast, compassionate response to the injured worker. A digital first notice of loss helps with OSHA compliance, and integrated telemedicine services promote a faster recovery for the injured person. Moreover, it provides better communication throughout the process, ultimately leading to a faster, less costly resolution of your claim.

How to apply for workers’ compensation in California

Foresight Commercial Insurance offers workers’ compensation programs in California. Work-related injuries are a risk to all businesses. If you are a employer in California, or if you are a Broker, Foresight’s insurance policies are here to help. Moreover, Foresight is the only Workers’ Comp Insurance Program that helps reduce costly claims by 20% – keeping premiums low year after year.

Footnotes

- California Labor Code, Article 2, “Employees,” sections 3300-3553.

- Lazarony, Lucy. “California Workers’ Compensation Insurance Laws,” Forbes Advisor. Nov 8, 2021.

- California Labor Code, Article 1, “Insurance and Security” section 3700.5

- California Department of Insurance, “Experience Modification.” Workers’ Compensation. Insurance.ca.gov/01-consumers

- Schillaci, William C., “Comparing the Standards of Federal OSHA vs. Cal/OSHA,” EHS Daily Advisor, Aug. 15, 2018.

- Esola, Louise, “California comp premiums remain high despite decreases: Report,” Business Insurance, July 22, 2019.